Investing in Open Plots on a Middle-Class Salary: A Realistic Guide

Investing in open plots is often seen as a domain reserved for the affluent. However, with careful planning and discipline, even a middle-class individual with a monthly salary of Rs. 20,000 can embark on this journey. Let’s break down how.

Understanding the Reality

Before we delve into the strategies, it’s crucial to acknowledge the challenges:

- High Initial Investment: Open plots, especially in promising locations, are typically priced beyond the reach of a monthly Rs. 20,000 salary.

- Long-Term Commitment: Real estate investments, particularly land, are long-term commitments. Immediate returns are unlikely.

- Opportunity Cost: Investing a significant portion of your income in a single asset means forgoing other investment avenues.

Strategies for a Middle-Class Investor

1. Start Small, Think Big:

- Micro-investments: Consider pooling resources with family or friends to buy a small fraction of a plot. This allows you to start with a smaller investment while being part of a larger asset.

- Land Banks: Some developers offer land banking schemes where you can invest small amounts periodically.

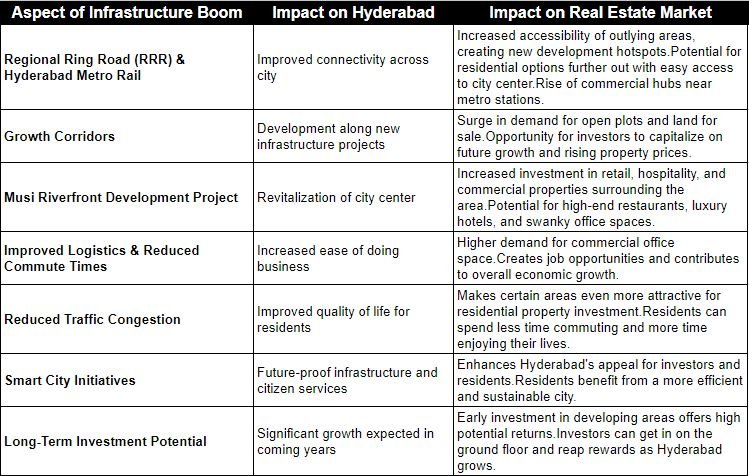

2. Location, Location, Location:

- Peripheral Areas: Focus on areas with potential for future development. While prices might be lower, there’s a chance of significant appreciation over time.

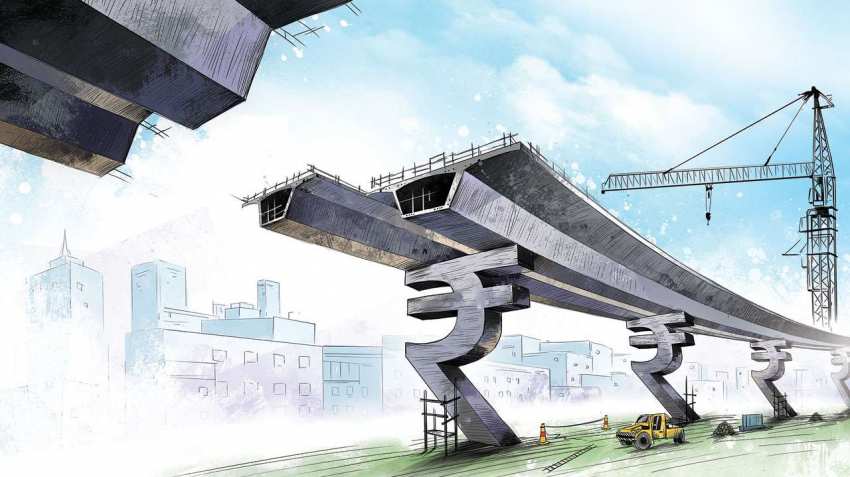

- Research: Understand the city’s development plans. Areas earmarked for infrastructure projects, like new roads, metro stations, or industrial zones, can see substantial value growth.

3. Systematic Investment Plan (SIP):

- Small, Regular Investments: Treat your plot investment like an SIP. Allocate a fixed amount every month towards your plot purchase.

- Compounding Benefits: Over time, the power of compounding can help you accumulate a significant sum.

4. Government Schemes and Subsidies:

- Explore Options: Research government schemes and subsidies that might assist in affordable housing or land purchase.

- Awareness: Stay updated on policies that can benefit you.

5. Part-Time Income and Savings:

- Additional Income: Consider part-time jobs or freelancing to supplement your income and accelerate your investment process.

- Strict Budgeting: Create a detailed budget, eliminating unnecessary expenses and maximizing savings.

6. Joint Ventures:

- Partnership: Collaborate with friends or family who share your investment goals. Pooling resources can help you acquire larger plots.

7. Long-Term Perspective:

- Patience: Real estate investments are marathon, not sprints. Avoid impulsive decisions.

- Diversification: While your primary focus is on the plot, consider diversifying your investments to manage risk.

Cautions and Considerations

- Legal Due Diligence: Ensure all land-related documents are clear and legally sound.

- Market Fluctuations: Real estate prices can fluctuate. Be prepared for market downturns.

- Liquidity: Your investment might be locked for an extended period.

- Opportunity Cost: Evaluate if the potential returns from the plot outweigh other investment options.

Conclusion

Investing in open plots on a middle-class salary requires patience, discipline, and a long-term perspective. While challenges exist, strategic planning, government schemes, and potential partnerships can pave the way. Remember, it’s about starting small, making informed decisions, and staying committed to your financial goals.